colorado paycheck calculator hourly

Well do the math for youall you need. By this scenario the gross paycheck formulas applied depend on the way the normal pay rate is specified as detailed below.

Free Paycheck Calculator Hourly Salary Usa Dremployee

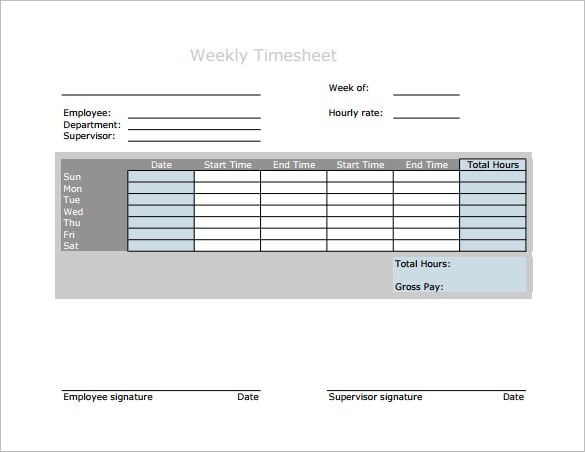

- In case the pay rate is hourly.

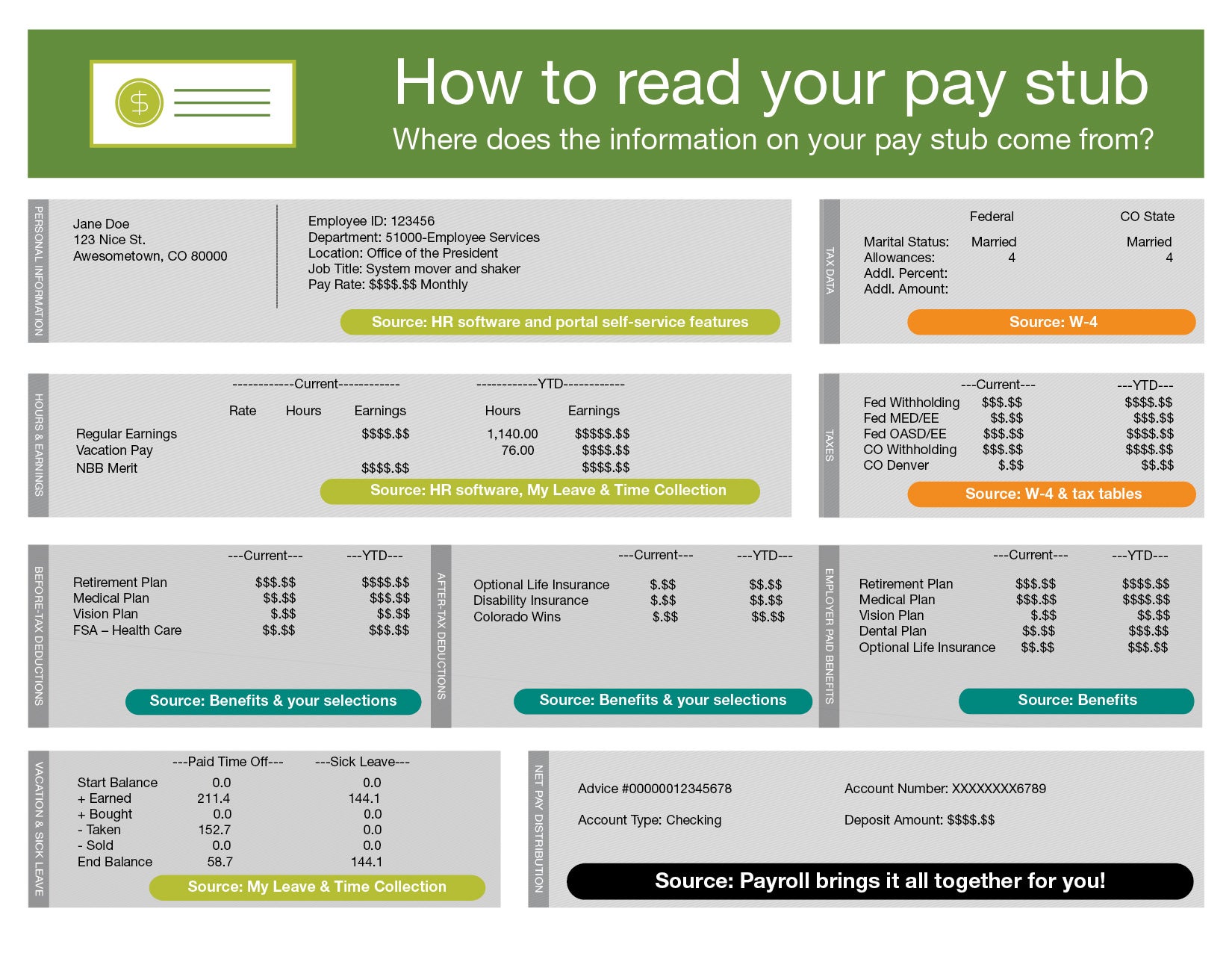

. Simply enter their federal and state W-4 information as. Just enter the wages tax withholdings and other information required. A state standard deduction exists and is available for those that qualify for a federal standard deduction.

According to the United States Census Bureau the average household income in. The algorithm behind this hourly paycheck calculator applies the formulas explained below. Along with a few other.

Use smartassets paycheck calculator to calculate your take home pay per. A Hourly wage is the value. Below are your Colorado salary paycheck results.

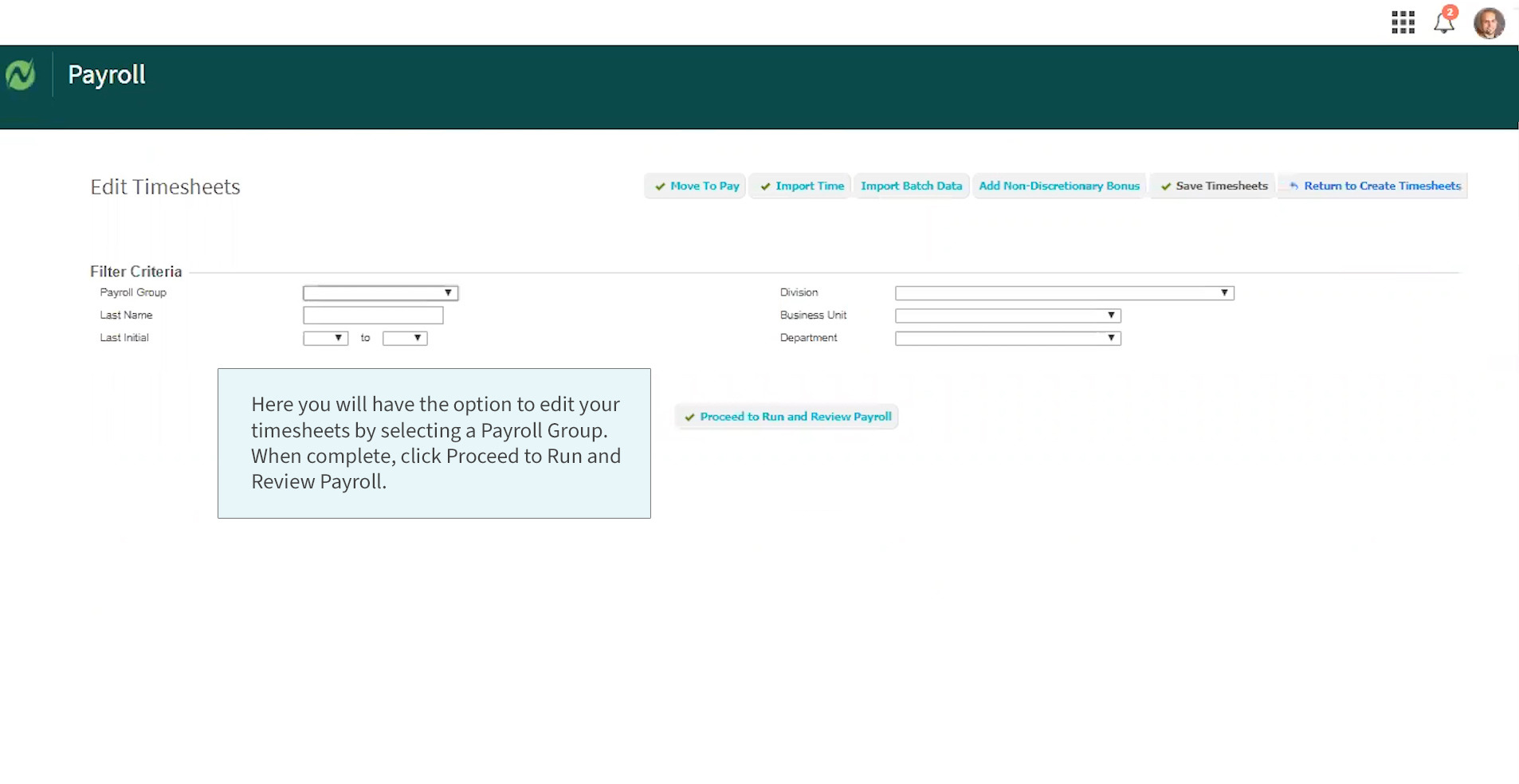

Calculating your Colorado state income tax is similar to the steps we listed on our Federal paycheck calculator. Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in Colorado. Use ADPs Colorado Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees.

Open an Account Earn 17x the National Average. This hourly paycheck calculator are for those who are paid on an hourly basis. Calculate your Colorado net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state.

Easy 247 Online Access. Then multiply that number by the total number of weeks in a year 52. -Overtime gross pay No.

Switch to Colorado dual salary calculator. This colorado hourly paycheck calculator is perfect for those who are paid on an hourly basis. The Colorado dual scenario hourly paycheck calculator can be used to compare your take-home pay in different Colorado hourly scenarios.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Colorado Salary Paycheck Calculator. Federal Payroll Tax Compliance - 2017.

And if youre in the construction. The state income tax rate in Colorado is a flat rate of 455. The results are broken up into three sections.

So the tax year 2022 will start from July 01 2021 to June 30 2022. It changes on a yearly basis and is dependent on many things including wage and industry. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information.

Multiply the hourly wage by the number of hours worked per week. For example if an employee makes 25 per hour and. Of overtime hours Overtime rate per hour.

Colorado Unemployment Insurance is complex. Colorado Paycheck Calculator also calculates local income and neighborhood taxes. This federal hourly paycheck.

-Total gross pay. No monthly service fees. SunBiz Calculators Free Payroll Calculators.

Paycheck Results is your gross pay and specific deductions from your paycheck Net Pay is.

Colorado Hourly Paycheck Calculator Paycheckcity

Paycheck Calculator Salary Or Hourly Plus Annual Summary Of Tax Holdings Deductions No Ads Amazon Com Appstore For Android

Paycheck Calculator Take Home Pay Calculator

Colorado Paycheck Calculator Smartasset

Paychecks University Of Colorado

![]()

Free Hourly Payroll Calculator Hourly Paycheck Payroll Calculator

Hourly Paycheck Calculator By Adp Ed O Neill Ltd Tax Professionals

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Paycheck Calculator Salary Or Hourly Plus Annual Summary Of Tax Holdings Deductions No Ads Amazon Com Appstore For Android

Annual Salary Calculator Payscale

Esmart Paycheck Calculator Free Payroll Tax Calculator 2022

Colorado Paycheck Calculator Smartasset

How To Calculate Payroll Taxes Methods Examples More

Hourly Paycheck Calculator Calculate Hourly Pay Adp

Paycheck Calculator Hourly Employee Paycheck Calculator

The Hourly Paycheck Calculator Netchex

7 Weekly Paycheck Calculator Doc Excel Pdf Free Premium Templates